In this article I’m going to talk about the different types of staking plans you can use in your quest for gambling profits. A book would be needed to cover every staking plan in detail so I’ll summarize the best I can.

- Kelly Staking Plan Formula Examples

- Kelly Staking Plan Formula Example

- Kelly Staking Plan Formula Calculator

- Kelly Staking Plan Formula Sheet

- Kelly Staking Plan Formulary

The most commonly quoted staking plan is Level stakes, with other popular ones being Variable staking, Progressive staking, Kelly Criterion staking and Percentage of bank staking. I’ll go through what each means and what my thoughts are on their plus and minus points.

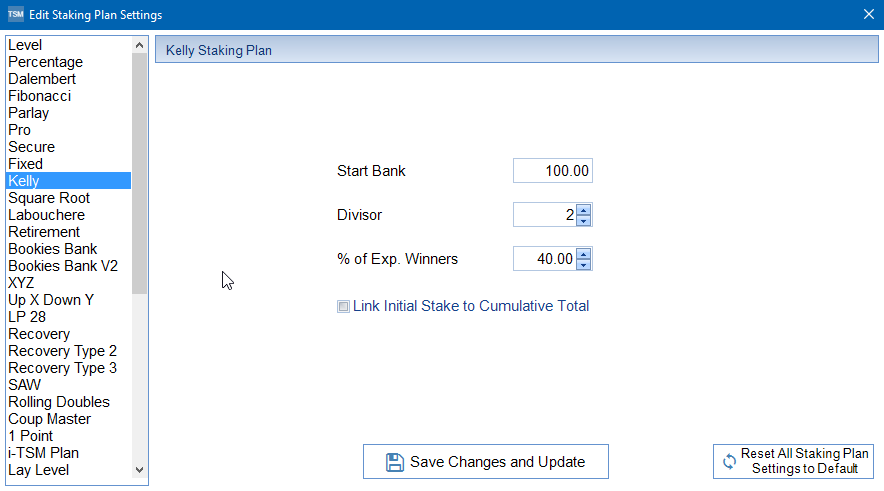

One of the most complex staking plans, the Kelly Staking strategy requires a mathematical formula to calculate bet sizes. The actual size of the bet is dependent on the edge the gambler has over the bookmaker. One of the complexities involved is being able to accurately work out what your edge is. Martingale System. The recommended Kelly criterion stake will be multiplied by this value. For standard Kelly betting, set the fractional Kelly betting value to 1.00. If you want to be more conservative than the Kelly criterion, enter a value less than 1 (e.g. Input 0.5 if you want to wager 50%.

Many tipsters quotes their profit figures (they never lose do they?) to level stakes in their advertisements. It is also the figure journalists and TV presenters throw at us when there quoting various trends for upcoming races, or matches. The problem with level staking however lies in its title. It means having the same stake on a 100/1 shot as a 1/2 shot. The result is, a few big priced selections, decide whether you end up in profit or not. Your variance will be huge, meaning you will have huge swings in your betting bank, and frankly there is very little logic behind a level stakes approach.

Let’s say a trainer had 30 runners over a period of the last 14 days and 29 of them started at 1/1 and the other runner was 100/1. All the 1/1 horses got beat but the 100/1 shot won. Would you say this particular trainer’s string was in form? No of course you wouldn’t but Level Staking would, as you’d be up €71 for a €1 level stake. One result has camouflaged a very poor run of hot favourites getting beat. You might say this is an extreme example but I find you have to us these examples to show up obvious flaws.

Kelly Staking Plan Formula Examples

Why then do the tipster’s and media use it to the exclusion of almost anything else? The tipsters will use whatever they can to make their product look better than it is. Level stakes will achieve this, as a few decent priced winners will give them a tidy profit and thus it gives them an opportunity to advertise after a particularly good period. They will hand-pick the exact period they were most profitable and using level stakes can make it seem even better than it really was.

It is the same with the stats quoted by various media outlets. Quotes like ‘such and such a trainer has a level stakes profit in novice chases at Kempton’ and thus they’ll tip up the trainer’s runner in a Novice chase at Kempton based solely on this logic. The sample size might have been only 10 runners with one 20/1 winner but that won’t put them off. People are paid to come up with these trends or stats so they can be presented to the public in print, or on TV. It is much easier to come up with stats that were profitable in the past if you have a small sample size and use level stakes as the proof of profit. Therefore I expect the reason the media use it, is firstly to make their job easier, and secondly ‘the sheep effect’. Everyone else does it so why shouldn’t I? I will always be very sceptical of any trends based on level staking unless the sample size is very big or the prices of the selections were within a tight band. I’m not saying that trends are to be ignored; just they need to be analysed properly in order to find the valuable ones.

Some in the media like Hugh Taylor of ATR and James Pyman of the Racing Post have used Actual/Expected winners a good bit lately to evaluate statistic’s and this is much better than Level Stakes as a barometer of whether the statistic has value.

Okay, enough level stakes bashing. Percentage of bank staking is still fixed stakes but you’re staking a certain % of your betting bank on each selection. Same flaws as level staking while being marginally better for punting purposes as at least now you’re including the size of your betting bank in your decisions.

Kelly Staking Plan Formula Example

Progressive staking is basically increasing stakes after a loser in order to have more money on the winners you back than the losers. Sounds very good in theory but in practice the bad losing run will wipe you out every time. You will win most of the time as a few winners will normally wipe out your loses and produce a profit. The problem comes when you get the really bad run that only happens rarely. You’ll have two problems. One your betting bank won’t have the ridiculous amount needed for the ever increasing stakes, and two even if it had, you won’t be able to get the bet amount needed on. Some plans like doubling your stake after a loser would soon need astronomical stakes after a relatively short losing run even if you started at just €5 bets. I’ve heard of people using this in casinos on the roulette table. They will win often but the loss when it comes, and it will come, will wipe them out. Some will say they only bet up till they have 8 losers but this will happen often enough, for the big loss incurred to be bigger than all the small profits accumulated. You can’t make money from a staking plan of any sort if you haven’t found an edge to begin with. Some will just put you in the poor house quicker.

Variable staking is much more sensible. It involves betting to win a certain amount rather then staking a certain amount. So if you bet to win 10 points you will have 10 points on a 1/1 shot and 1 point on a 10/1 shot. This is better but it also has flaws especially with the advent of exchanges and the ability to lay horses. Laying a horse at 33/1 for instance to win 10 points would involve a liability of 330 points and brings back the variance problems of level staking. You are in fact laying bets to someone who is using level staking against you, which will of course mean huge swings in your bankroll.

The Kelly Criterion was developed by mathematician John Kelly and is perhaps the soundest approach. It involves a formula which takes into account your current betting bank, the price of the selection and the edge you think you have on the bet. If your bank is €1000 and you’re backing a horse a 1/1 shot your bet will be bigger if you think you have a 10% edge rather than 5%. This is sound logic but the problem in its application is guessing the exact size of your edge. People in general overestimate such things which could result in over staking in relation to your bank. Kelly Staking is in its simplest form, your edge divided by the fractional price your’re backing at. So if your getting 6/4 on an 1/1 shot your edge is 2.5/2.0= 1.25 so an edge of 25% divided by 1.5 which equals a stake of 16.66% of your bank. I should warn an edge like that would require some serious inside info. There are many Kelly Criterion Staking Calculators online.

I use a variation of the Kelly Criterion in that I bet to get back a certain percentage of my bank. This would be the same as the methodology used for Actual/Expected winners. For example I might stake to get back 4% of my bank on each bet. If my bank is €10,000 and I’m backing a horse at 3/1 I will have €100 on. If the horse was 1/1 I would have €200 on. Both bets return €400. It would be the same for laying. You could also stake to return the same amount each time ignoring the fluctuations of your bank. If your bank was €1000 you could stake to return €40 on each bet. You’d stake the same regardless of whether your bank goes up or down. The problem with this is you can go bust, as if your bank drops to €100 you will still be betting as much as when it was €1000. The advantage over my method however is, you will recover from the losing runs, that don’t bust you, allot quicker. I believe either of these staking plans is infinitely better than level stakes, although incorporating a bit of the Kelly Criterion would be best. For instance you might normally stake to return 4% of your bank but might increase it to 6 or 8% if you think a bet is extra good value.

I discuss the factors to consider when deciding how much of your bank you should be staking in an article about betting bank and bankroll management.

For further reading I recommend Fixed Odds Sports Betting: The Essential Guide: Statistical Forecasting and Risk Management

If you found this article interesting, please share a link to it, via the social media buttons, your own blog, or forums.

Last updated by at .

Introduction

Kelly Staking Plan Formula Calculator

Professional gamblers adopt a carefully considered staking strategy in order to achieve long term growth of their betting bank. Some staking strategies are very simply whilst others can be very complex involving mathematical formulas to determine exactly how much to stake.

In summary your staking plan is trying to achieve an acceptable balance between risk and reward. Risk being defined as the possibility of losing your entire betting bank, and reward being the growth of your betting bank. There are many well known staking plans and you will find that many professional gamblers will have a custom staking plan based on one of these, which they have then fine tuned over the years for their own, exact requirements.

Mainstream Staking Plans

Some of the more well known staking plans are:

Level Stakes Betting Percentage Bank Staking Kelly Staking Martingale System

We will shortly be taking a detailed look at each of these different staking strategies. For the time being though we have provided a summary of the basics below.

Level Stakes Betting

The idea with level stakes betting is that you bet the same amount on all selections, regardless of the odds and current size of your bank. This is one of the simplest staking strategies and also one of the lowest risk staking strategies around.

Percentage Bank Staking

In contrast to level stakes betting, with percentage bank betting you adjust the size of your bets to reflect the current size of your bank. Each bet should represent a fixed percentage of you bank, for example, you may decide you will always bet 2% of your bank. After a loss the next bet will be smaller, after a win the next bet will be bigger. The basic idea is that in bad runs your stakes get smaller and smaller to ensure you don't burn your whole bank. In contrast, when you are on a hot streak, your bets would become bigger and bigger to accelerate the growth of your bank. This can appear to be an appealing proposition but in reality there is more to it, rather than runs of losses and runs of wins the 2 are generally mixed together.

Kelly Staking

One of the most complex staking plans, the Kelly Staking strategy requires a mathematical formula to calculate bet sizes. The actual size of the bet is dependent on the edge the gambler has over the bookmaker. One of the complexities involved is being able to accurately work out what your edge is.

Kelly Staking Plan Formula Sheet

Martingale System

The Martingale system is quite straight forward - if you lose a bet, place a larger bet next time to recover your losses and make a profit, if you lose again, increase your bet again. The big floor here is that bet sizes can increase very quickly and you can soon encounter either of 2 problems. The first is that the required bet size could be well over the size of your bank. The second is that the required bet, even if you can fund it, may exceed the maximum stake size allowed by the bookmaker.

Additional Info:

Kelly Staking Plan Formulary

Buy Horse Racing Tips Free Horse Racing Tips Free Bets